buy now pay later

Atome’s BNPL debuts on Taobao Singapore

Atome’s BNPL debuts on Taobao Singapore

Every Saturday, Atome shoppers can enjoy a $12 off for a $120 minimum spend.

PH’s BillEase clinched $5m investment from Credit Saison lending arm

BillEase has achieved profitability in 2023 and delivered 47% return on equity.

BNPL provider Atome Financial doubles operating income in 2023

It’s BNPL services are now profitable, the company said in a press release.

Superapps to help drive BNPL userbase to 670 million by 2028

Superapps like WeChat and Grab are adopting and offering BNPL services to users.

Australia’s Zip teams up with Primer to accelerate US expansion

Primer is expected to help drive distribution of Zip’s BNPL services in the market.

PayPal is most popular digital payment option in Asia: study

In the BNPL space, Klarna, Atome, and Afterpay are the region’s most popular choices.

Atome’s buy now pay later service now available in Amazon Singapore

Customers can opt to pay in three installments with zero interest through Atome.

Weekly Global News Wrap: Klarna, Block execs calls UK’s planned BNPL regulations “outdated”; Citi’s global FX head to leave

And fintech Boost looks to raise $50m to $100m in possible new funding round.

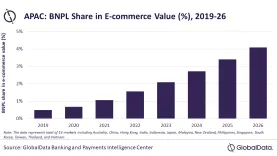

Digital wallets on track to be Singapore’s top online payment method by 2026

BNPL is set to surpass US$1b in transaction value by 2026.

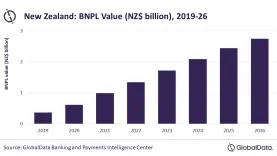

Chart of the Week: New Zealand’s BNPL market value to reach $1.2b in 2023

By 2026, the transaction value is expected to grow to $1.9b.

Financial stability a priority for Hong Kong: finance secretary

Chan expects more support from mainland China as the latter’s economy recovers.

Buy now, pay later gains traction in Asia

BNPL brand Afterpay served 20 million customers in Australia alone.

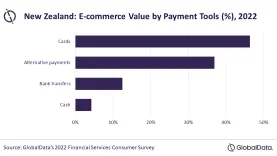

Alternative payments inch closer to e-commerce domination in New Zealand

The growth of BNPL has pushed up adoption of alternative payments.

BNPL code launched, outstanding payments limited to S$2,000 without credit assessment

Consumers are now entitled to make full repayment without early repayment fees.

Buy Now, Pay Later firms' credit losses on the rise

The largest BNPL providers have doubled their delinquency rates over the past few quarters.

Boom or bust? Buy now pay later flourishes but with default risks rising

Rising rates and tightening policies hurt borrowers’ repayment capacities and push up operating costs.

PayMongo, Atome offers BNPL services to 10,000 Philippine merchants

This comes as the share of cash payments is expected to fall further by 2025.

Advertise

Advertise