Chart of the Week: Vietnam banks' capital buffers to remain under pressure

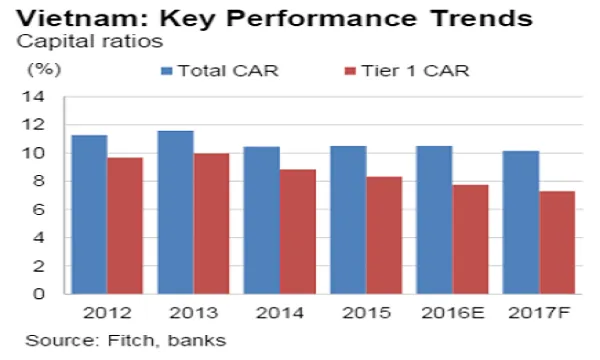

The banks' capital adequacy ratios are arely above the minimum requirement of 9%.

Capital adequacy ratios for commercial banks and state-owned banks in the first half of 2016 were 12.1% and 9.3%, respectively. Fitch Ratings says this is barely above the minimum regulatory requirement of 9%.

Here's more from Fitch:

Fitch believes the underlying capitalisation is likely to be even weaker in light of industry-wide under-reporting of NPLs. We expect capital buffers to remain under pressure as Basel II capital-adequacy standardsa are being phased in at a time when loan growth has picked up - in addition to their weak internal capital generation.

Ten banks have been designated to move to Basel II, with full adoption expected by end-2018. We expect banks' CARs to be pushed lower by the shift to a relatively more conservative regime.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise